corporate governance

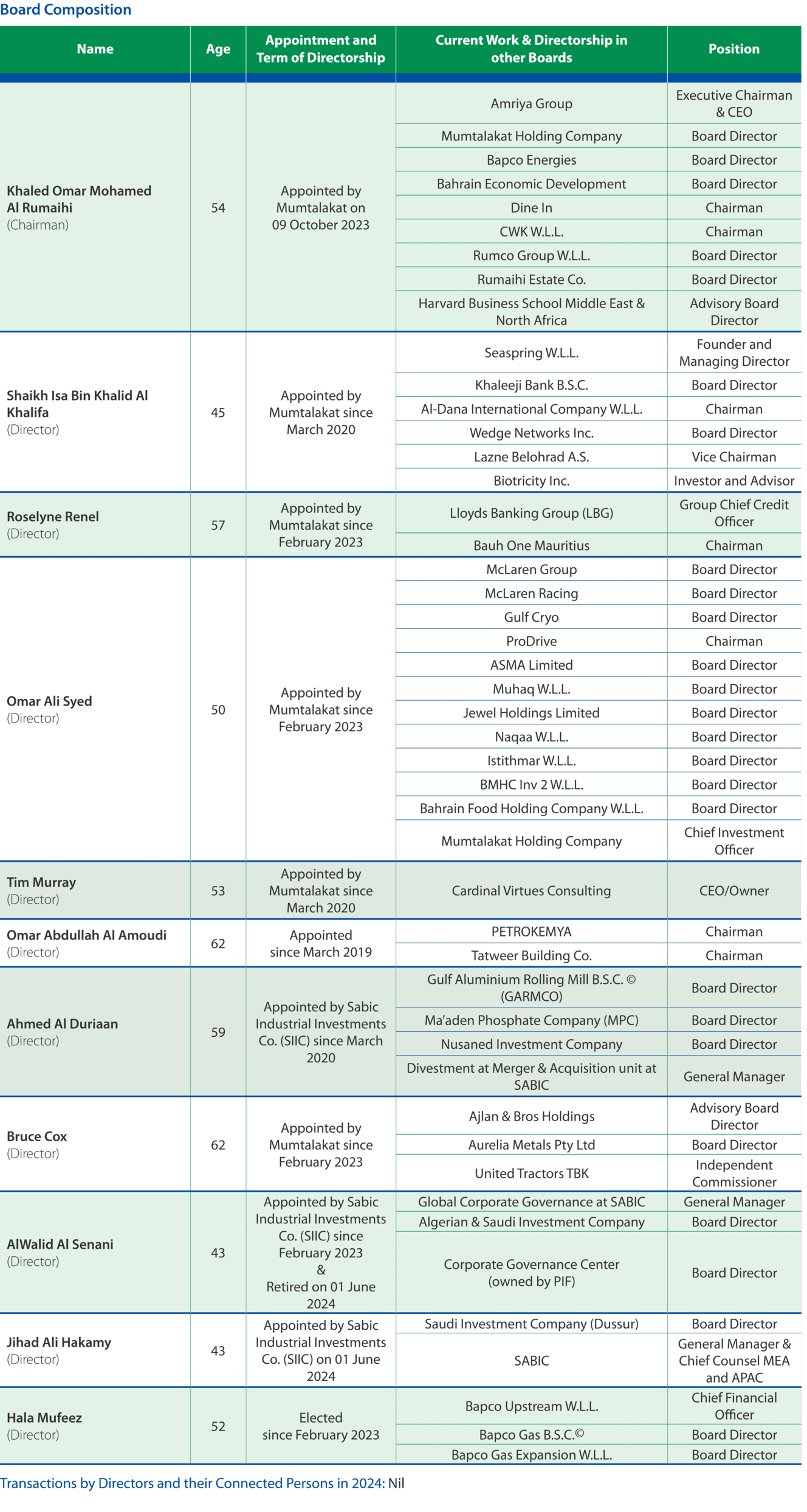

As per Article 24 of Alba’s Articles of Association, Alba is administered by a Board of Directors consisting of 10 directors who are appointed and/or elected in accordance with Article 175 of the Commercial Companies Law for a 3-year renewable term. Alba’s recent Board term started on 26 February 2023 and will end in February 2026.

During the Annual General Meeting on 26 February 2023, Bahrain Mumtalakat Holding Co. B.S.C. (c) (Mumtalakat) appointed 6 Directors: Shaikh Daij bin Salman bin Daij Al Khalifa (retired on 08 October 2023), Shaikh Isa bin Khalid Al Khalifa, Mr. Tim Murray, Mrs. Roselyne Renel, Mr. Omar Syed, and Mr. Bruce Cox while Sabic Industrial Investments Co. (SIIC) appointed 2 Directors: Mr. Ahmed Al Duriaan & Mr. AlWalid AlSenani. Mr. Omar Al Amoudi was also appointed at the General Meeting in line with Article 26 of Alba ‘s Article of Association. In addition, Mrs. Hala Mufeez was elected during the Annual General Meeting [out of 16 candidates who have nominated themselves for the elected director membership as per the regulatory filing on 12 February 2023] by the shareholders to represent the 10% free float.

On 07 March 2024, Alba shareholders approved the appointment of Mr. Khalid Al Rumaihi as the Chairman of the Board following his appointment by Bahrain Mumtalakat Holding Co. B.S.C. (c) (Mumtalakat) on 09 October 2023 to serve in the current Board term (until 2026).

On 30 May 2024, Sabic Industrial Investments Co. (SIIC) appoints, as per Alba’s Article of Association # 24, a new Board Member for Aluminium Bahrain B.S.C. (Alba’s) Board of Directors, Mr. Jihad Ali Hakamy effective 01 June 2024 (following the resignation of Mr. AlWalid AlSenani) to serve in the current Board term until 2026 and subject to CBB and the shareholders’ approvals in the Annual General Meeting in 2025.

In compliance with the Corporate Governance Code: Principle 4 and HC High Level Control Volume 6 by CBB, an induction session was arranged on 25 June 2024 for Mr. Jihad Ali Hakamy, the newly appointed Director, for familiarisation about Alba and its Corporate Governance practices. He also received a Handbook outlining key policies and Directors’ responsibilities.

- Term: The membership of Directors concludes at the end of the current term (2026).

- Re-appointment/Re-election: Directors are subject to re-appointment or re-election upon term expiration.

- Termination: The Directorship of any individual may be terminated if they breach the conditions outlined in Article 27 of the Alba’s Articles of Association.

- Annual Performance Assessment: In accordance with Chapter Two: Section One: Principle Eight of the Corporate Governance Code, the Board and its Committees conduct an annual performance assessment (including individual evaluation) to assess their effectiveness.

- 2024 Assessment: All Directors completed the relevant questionnaires for the year-ended 2024, and the outcomes were satisfactory.

- Board Composition: The Board of Directors is of the opinion that the qualifications of its members match the competencies that the Board should possess collectively and individually.

- Annual Evaluation:The Company conducts an annual independency evaluation of all Directors to determine their independent status.

- Evaluation criteria:The evaluation adheres to the criteria outlined in Appendix 1 of the Corporate Governance Code.

- Reporting:The results of the independency evaluation are disclosed to the Central Bank of Bahrain via the General Information Report.

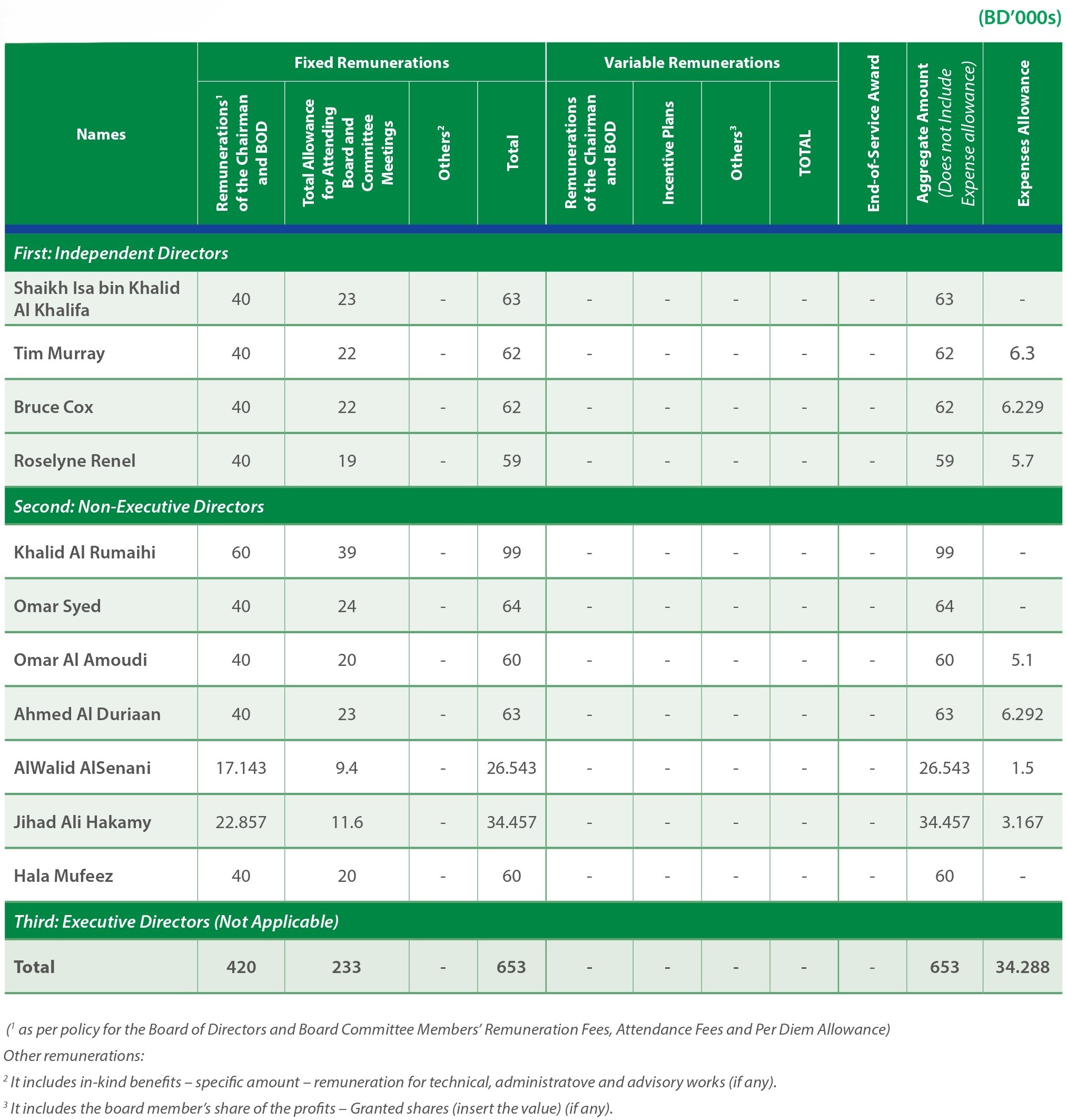

The Board of Directors are remunerated fairly and responsibly for fulfilling the duties of the Board and its Committees. For 2023, Remuneration Fees were BD420,000 [BD60,000 for the Chairman and BD40,000 per Director] excluding Sitting Fees (BD70,800) and Attendance Fees (BD1,000 per Director per meeting) of BD113,000. In total, the aggregate amount for 2023 was BD603,800 in addition to Expense Allowances of BD18,377 [refer to Note 27 in Alba’s Consolidated Financial Statements of 2024]. For 2024, Attendance Fees (BD1,000 per Director per meeting) and Allowance Fees1 were paid to the Directors for attending the Board and Committee meetings during 2024. Sitting fees of BD72,000 for 2024 (part of Total Allowance for Attending Board and Committee Meetings) will be paid after the Board’s meeting on 18 February 2025 (to refer to the below table for the full breakdown of 2024 Remunerations).

The proposed Remuneration Fees for 2024 will be paid post the AGM which is scheduled to be held on 12 or 13 March 2025 and subject to the shareholders’ approvals.

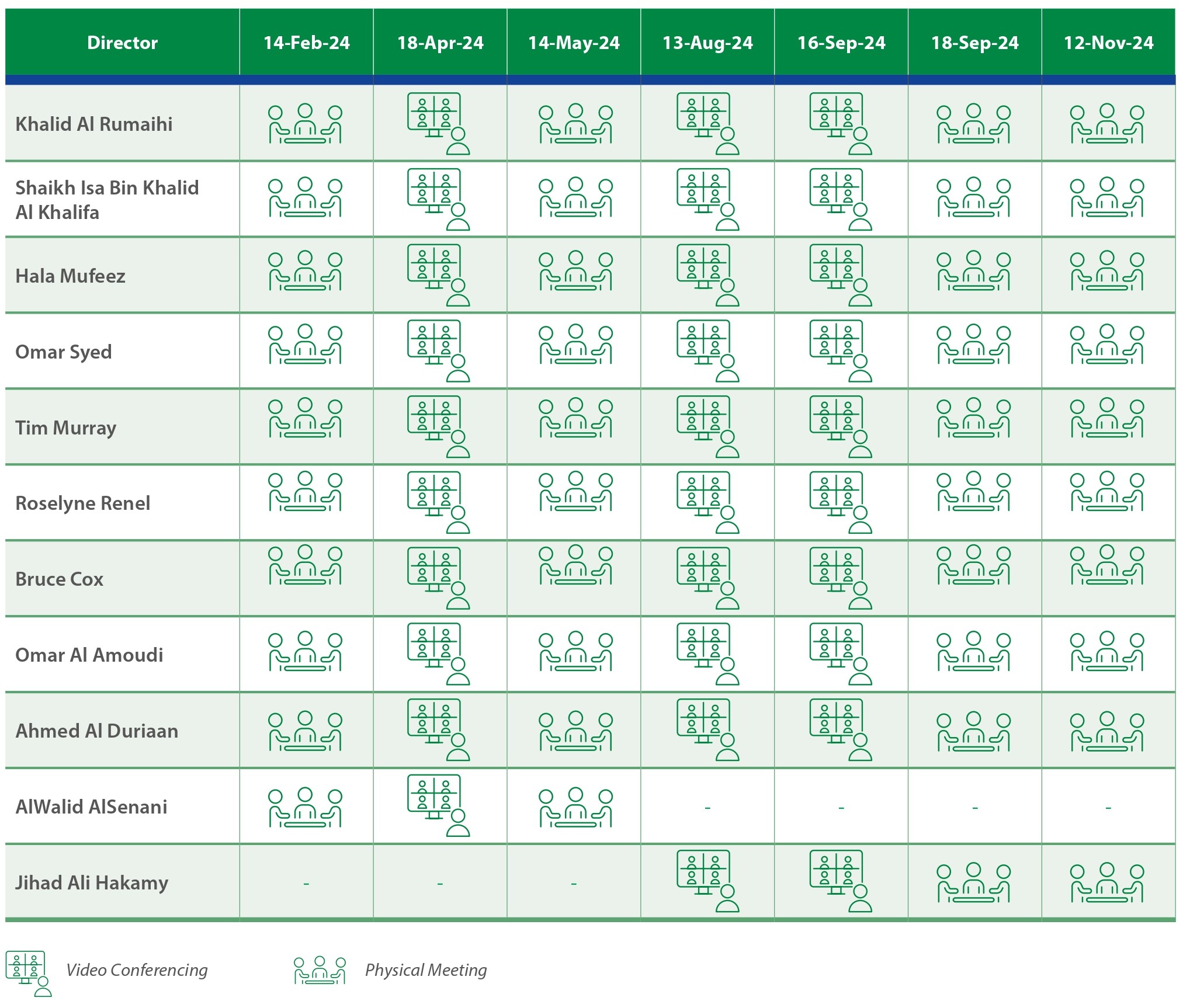

Meetings of the Company’s Board of Directors are held at least quarterly or more frequently as deemed necessary. There were 7 Board Meetings in 2024 which were held on 14 February, 18 April, 14 May, 13 August, 16 September, 18 September, and 12 November. Four regular Board meetings in Q1, Q2, Q3 and Q4 of 2024 were held in person while two ad-hoc Board meetings were held virtually via Microsoft Teams on 18 April and 16 September; in addition, one Board meeting for approving Q2 & H1 2024 Financials was held virtually via Microsoft Teams on 13 August.

Pursuant to Chapter 2 -- Corporate Governance Principles, Section One, Principle 1: the Company Shall be Headed by an Effective, Qualified and Expert Board -- in the Corporate Governance Code 2022, the Chairman of the Board’s responsibilities include but not limited to:

- Representing Alba before others;

- Ensuring that the directors have access to complete and accurate info in a timely manner;

- Ensuring that the Board discussed all information as stated in the agendas for each meeting;

- Encouraging effective communication between Alba’s shareholders and BoD;

- Encouraging all directors to effectively exercise their roles in the best interest of Alba;

- Preparing agendas for the Board meetings and General Assembly meetings (AGM and EGM); and

- Holding meetings with non-executive and independent directors without the attendance of the executives to take their views on matters related to the company’s activity.

Pursuant to Chapter 2 -- Corporate Governance Principles, Section One, Principle 1: the Company Shall be Headed by an Effective, Qualified and Expert Board -- in the Corporate Governance Code 2022 and in addition to Alba’s Memorandum and Articles of Association of the Company (the “Articles”), the Board’s duties include but not limited to:

- Setting and monitoring the overall business strategy and business plan for the Company;

- Ensuring that the operations run smoothly to achieve the company’s objectives and that they do not conflict with the applicable Laws and Regulations;

- Reviewing and approving financial statements which accurately disclose the Company’s financial position;

- Monitoring management performance;

- Convening and preparing the agenda for shareholders’ meetings;

- Monitoring conflicts of interest and preventing abusive related-party transactions;

- Assuring equitable treatment of shareholders including minority shareholders;

- Exercising all powers and performing necessary acts for the management of the Company in conformity with its objectives, within the bounds of the Law, the Articles of Association, and resolutions of the General Meetings;

- Setting and reviewing key Company policies;

- Determining the remuneration for Directors, subject to the approval of the shareholders’ Annual General Meeting, taking into consideration the provision of Article 188 of the Commercial Companies’ Law;

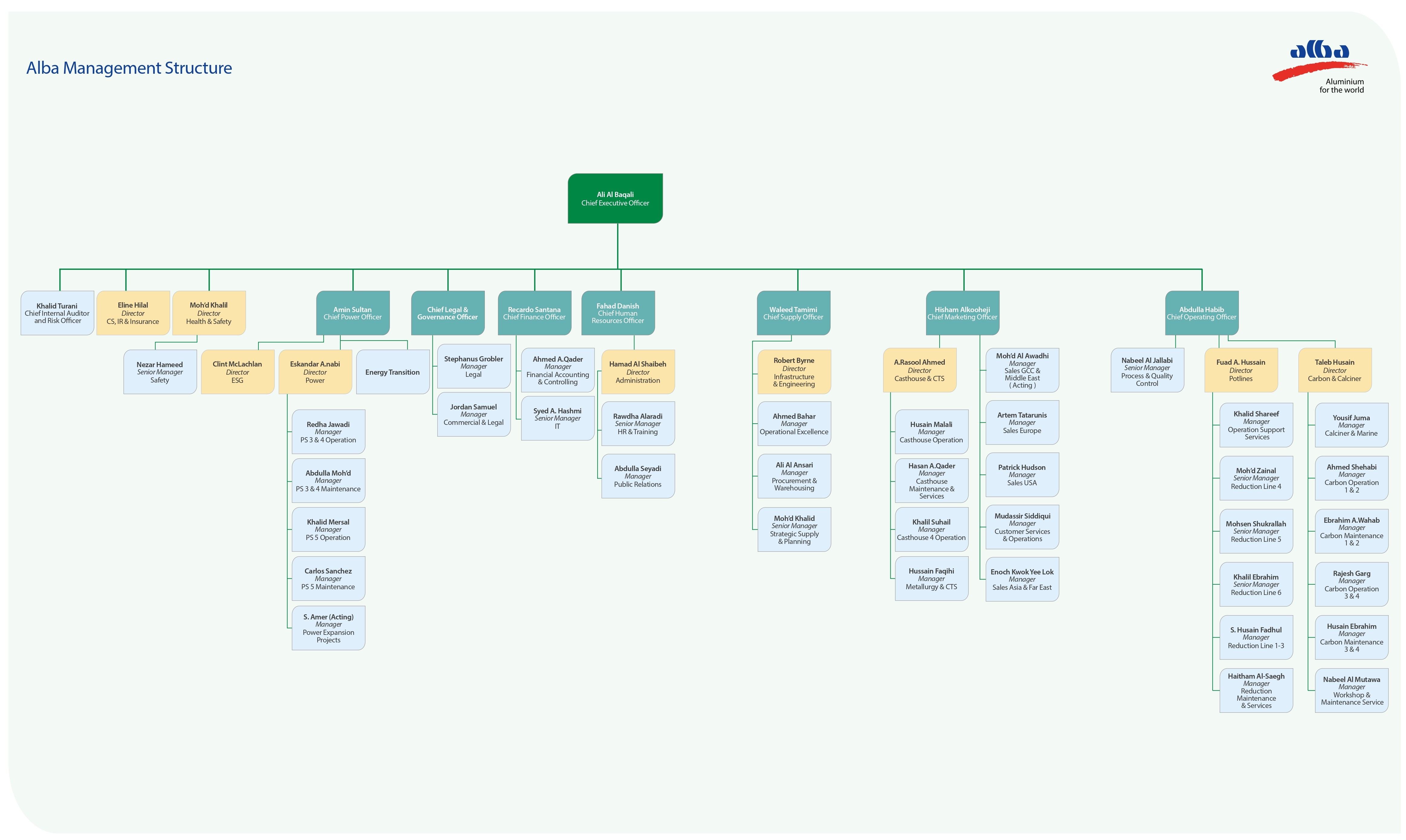

- Setting the Management structure; appointing or removing key/senior executives and employees, determining their duties, setting their remuneration and incentive programmes, (ensuring that these are aligned with the long-terms interests of the Company and shareholders), and overseeing succession planning;

- Forming Executive and ESG, Audit and other Committees, appointing their members and specifying their powers, as well as ensuring a formal board nomination and election process;

- Ensuring the integrity of the Company’s accounting and financial reporting systems, and that appropriate systems of control are in place, particularly for risk management, financial and operational control as well as compliance with the law and relevant standards; and

- Approving matters reserved to the Board in the ‘Levels of Authority’ document reviewed by the Board from time to time.

- Investment and expansion projects above monetary thresholds in accordance with capital expenditure policy approved by the Board and as set out in the LoA;

- Sales and purchase contracts (materials and services) greater than 5-years and, in some instances, above certain monetary thresholds and contract quantities;

- Equity and dividend related recommendations for Shareholders’ approval;

- Recommendation of acquisitions, mergers, diversification, divestment, expansions, and other business combination related decisions for Shareholders’ approval;

- Strategic hedging strategies;

- Cumulative short-term borrowing limits;

- Annual Operating Plan and Annual Marketing Plan; and

- Key policies such as the Levels of Authority (LoA), Code of Conduct, Tender Policy, Risk Management Policy, Capital Expenditure Policy, Board and Committee Charters, and key HR Policies.

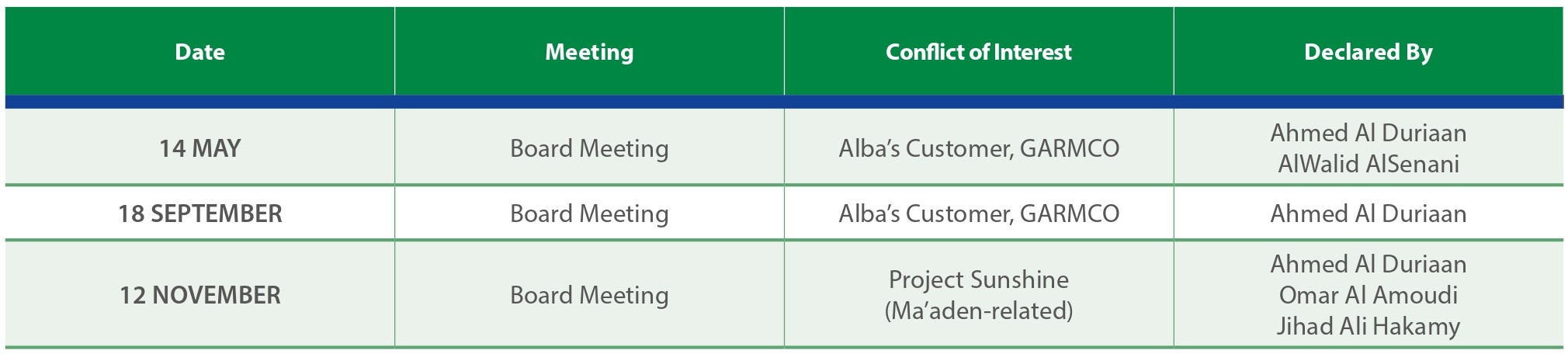

Alba empowers its Board members to uphold the highest standards of ethical conduct by emphasizing the absolute need for prompt disclosure of any conflicts of interest, whether stemming from the Board and Committees’ agenda items or external appointments, that could impair their judgment. Prior to every Board and Committee meeting, the members are notified of their obligation to disclose any potential conflicts of interest.

In 2024, the Board members set a strong example by actively declaring conflicts and abstaining from voting in relevant matters

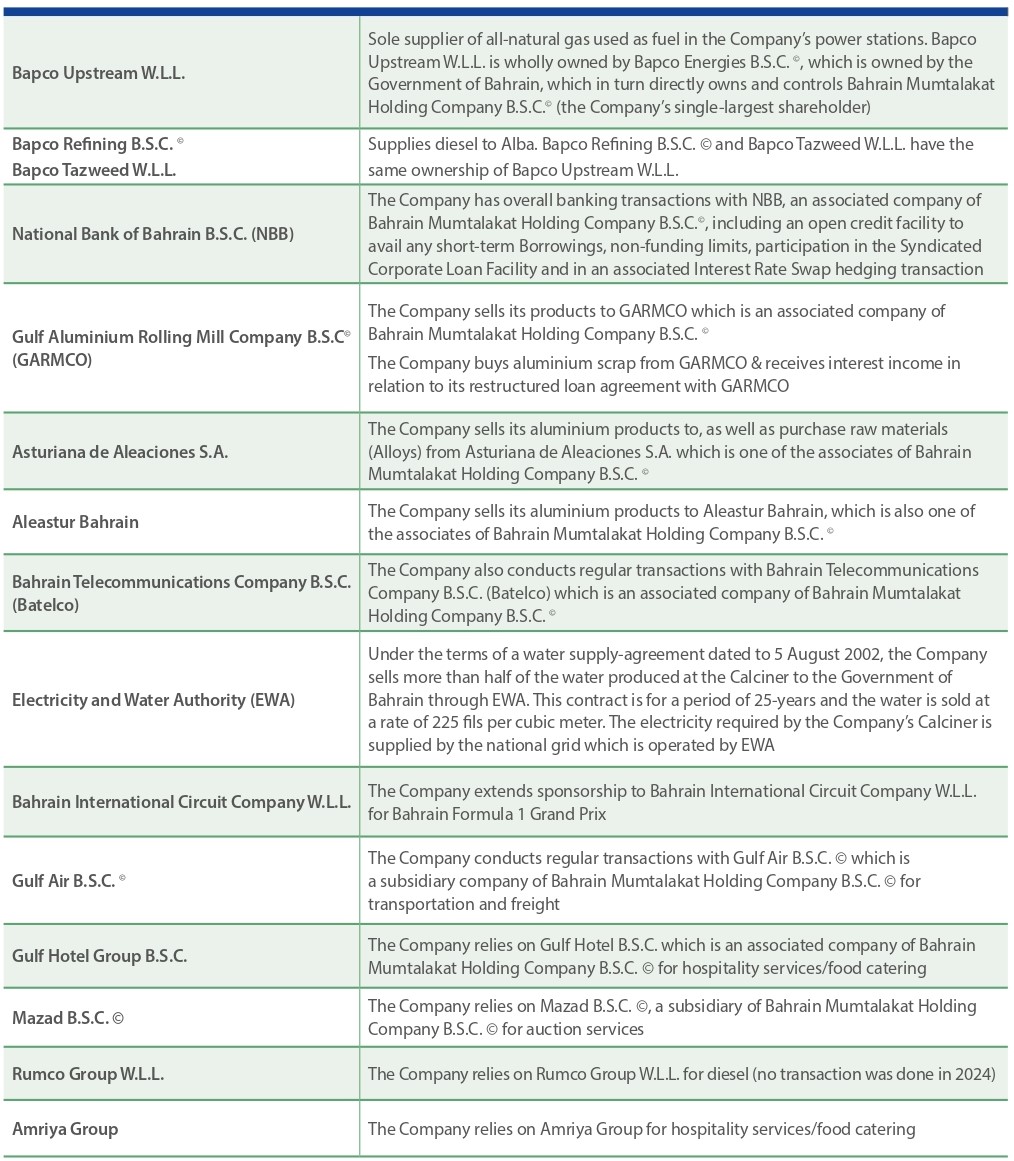

Alba undertakes transactions with related parties as part of its ordinary course of business. As per the definitions by the International Accounting Standards 24 Related Party Disclosures (IAS 24), the Company qualifies as a government related entity. The Company purchases gas and receive services from various government and semi-government organisations and companies in the Kingdom of Bahrain. Other than the purchase of natural gas, other conducted transactions for the normal course of business are not considered to be individually significant in terms of size. Related party transactions of material nature are discussed by the Board and are as follows:

In addition, around 50% of the land housing Alba’s various facilities is licensed or leased to the Company by the Government of Bahrain or entities directly or indirectly owned/controlled by the Government of Bahrain. Further information can be found in Note 25 – Transactions with Related Parties in Alba’s Consolidated Financial Statements of 2024.

To note, all transactions with Related Parties and/or intra-company are done on arms’ length and audited by the Company’s External Auditors

In alignment with best corporate governance practices, Alba Board of Directors has established a robust committee structure to effectively oversee critical areas of the Company’s operations. These Committees, each with a clearly defined charter, enhance the Board’s ability to fulfill its fiduciary duties and make informed decisions. The following chart summarises the Company’s Board Committee Structure

The Board Audit Committee is responsible to review financial reporting, internal controls, and legal adherence in addition to recommending and overseeing the external audit process

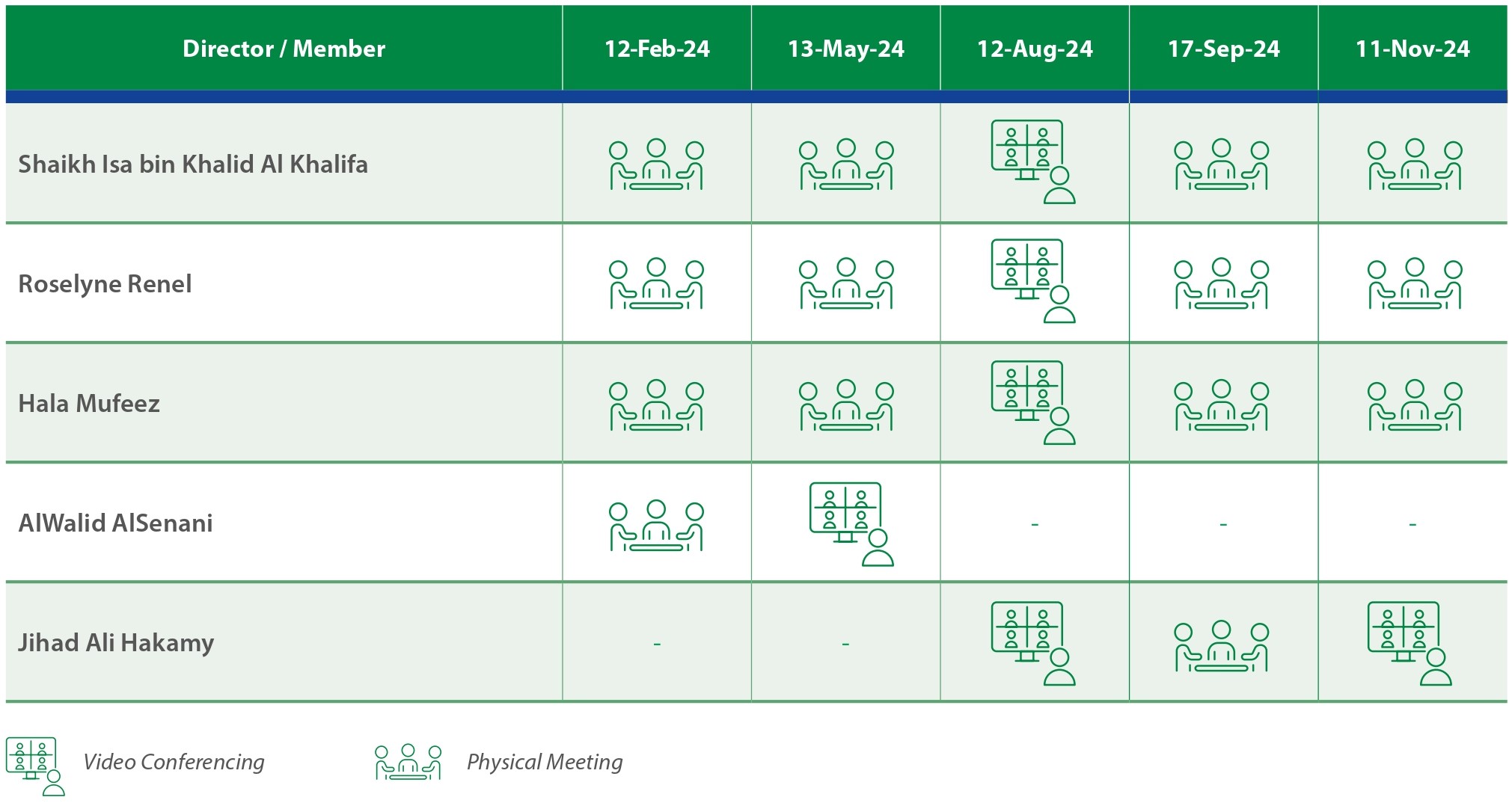

The Board Audit Committee comprises four Directors all of whom are non-executive and half of them are independent. The Board Audit Committee (BAC) consists of: Shaikh Isa bin Khalid Al Khalifa (the Chairman of BAC who is independent), Mrs. Roselyne Renel (independent), Mrs. Hala Mufeez (non-independent), and Mr. Jihad Ali Hakamy who joined Alba’s BoD on 01 June (non-independent). To note, Mr. AlWalid AlSenani (former member of the BAC) retired from Alba’s BoD on 01 June.

As per the Charter of the Board Audit Committee (last version was approved on 14 February 2024), the Directors are required to meet at least 4 times a year and/or when necessary. In 2024, the Board Audit Committee met 5 times on 12 February, 13 May, 12 August, 17 September, and 11 November. Four regular BAC meetings were held in person in Q1, Q2, Q3 and Q4 of 2024 while one BAC meeting for endorsing Q2 and H1 2024 Financials was held virtually via Microsoft Teams on 12 August.

The responsibilities of the Nomination, Remuneration

and Corporate Governance Committee revolve around

three core areas:

- Board Nominations/Appointments: Ensuring independence, qualifications, and diversity of board members in compliance with regulations.

- Compensation: Establishing and overseeing fair and responsible compensation packages for C-suite levels in addition to directors’ remuneration.

- Corporate Governance: Monitoring compliance with legal and ethical standards.

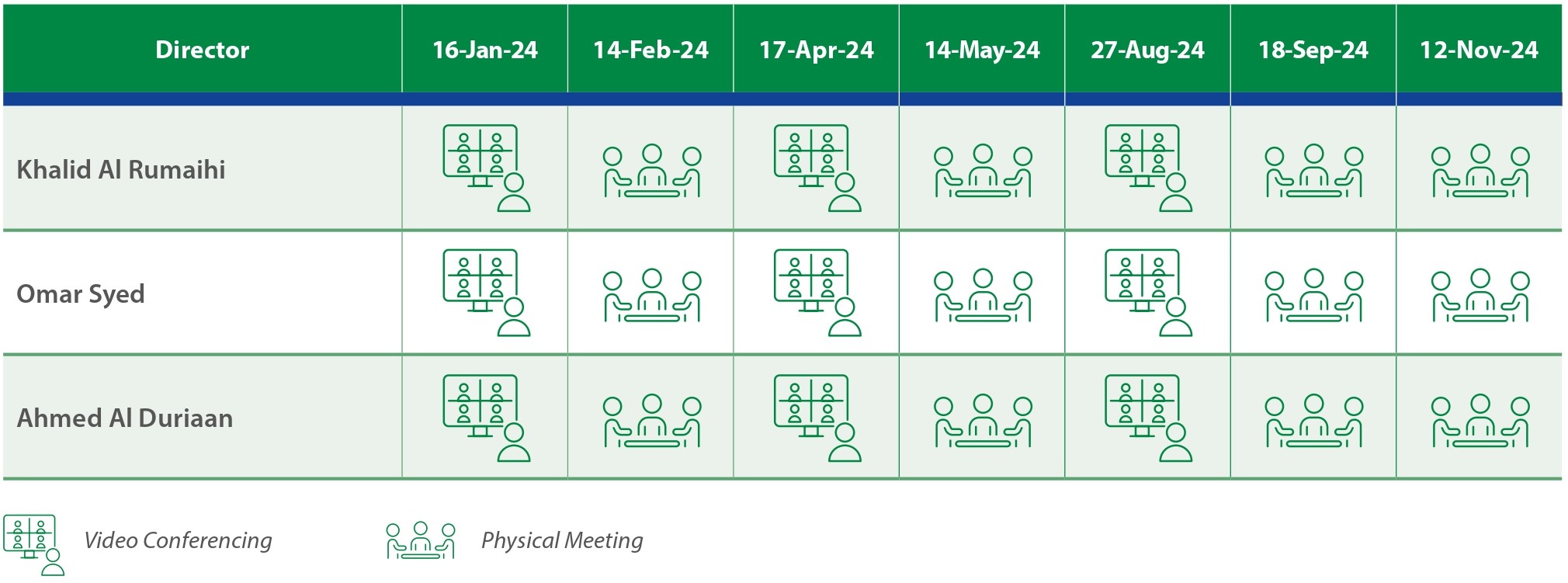

The Nomination, Remuneration and Corporate Governance Committee comprises three Directors - all of whom are non-independent and non-executive Directors. The NRCGC consists of Mr. Khalid Al Rumaihi (who chairs this Committee) and two other Directors Mr. Omar Syed and Mr. Ahmed Al Duriaan.

As per the Charter of the Nomination, Remuneration & Corporate Governance Committee (last version was approved on 10 June 2020), the Directors are required to meet at least 4 times a year and/or when necessary. In 2024, the Nomination, Remuneration & Corporate Governance Committee met 7 times on 16 January, 14 February, 17 April, 14 May, 27 August, 18 September, and 12 November. Four regular NRCGC meetings were held in person in Q1, Q2, Q3 and Q4 of 2024 except for the ad-hoc NRCGC meetings which were held virtually via Microsoft Teams on 16 January, 17 April and 27 August.

The Board Executive and ESG Committee acts as the Board’s strategic compass, guiding long-term and mid-term planning, vetting projects, and optimizing resources. It also ensures efficient execution with strong governance and ESG principles while aligning with the Kingdom of Bahrain’s Net Zero Emissions by 2060.

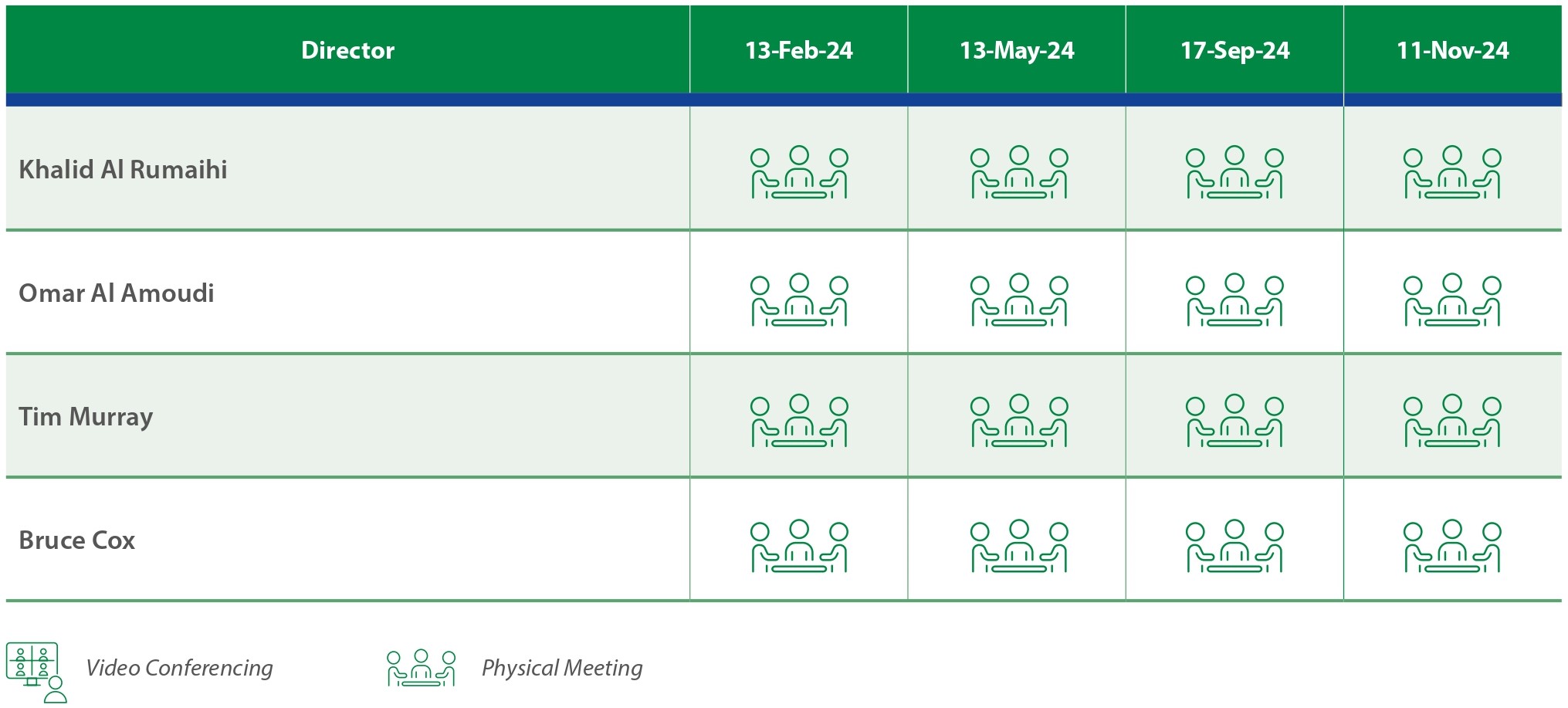

The Board Executive and ESG Committee comprises four Directors - half of whom are independent, and all are non-executive Directors. The Board Executive and ESG Committee consists of Mr. Khalid Al Rumaihi (who chairs this Committee and is non-independent) and three other Directors Mr. Omar Al Amoudi (non-independent), Mr. Tim Murray (independent) and Mr. Bruce Cox (independent).

As per the Charter of the Board Executive and ESG Committee (last version was approved on 28 September 2022), the Directors are required to meet at least 4 times a year and/or when necessary. In 2024, the Board Executive Committee met 4 times on 13 February, 13 May, 17 September and 11 November. The Executive and ESG Committee meetings in Q1, Q2, Q3 and Q4 of 2024 were held in person.

Effective September 1, 2018, Ms. Eline Hilal assumed

the role of Corporate Governance Officer for

Aluminium Bahrain B.S.C. (Alba). Below are the

contact details:

Office No.: +973 1783 5100

Mobile No.: +973 39907255

Email address: eline.hilal@alba.com.bh

Alba Enterprise risk management enables the Board and the Management to effectively deal with uncertainty across the organisation. It enhances value by maximizing opportunities, and minimizing the consequences and likelihood of threats, ensuring that risks are kept within an acceptable level across the entity. Risk management is a central part of Alba’s governance process and management system. The process starts in the decentralized teams within each of the Executive Management areas who is extensively knowledgeable of the risks within their areas of responsibility. They systematically identify, quantify, respond to and monitor risks at process and departmental level. With this decentralization, teams are placed to mitigate Alba’s risk exposure in the first instance. Based on understanding the business and its objectives, the risks are categorized into four areas: (1) Strategic (2) Operations (3) Compliance (4) Financial.

Different risk treatment options are utilized by the risk owners to ensure that risks are managed within the business context, business objectives, performance targets, and the Company’s risk appetite.

Our risk management processes are continuously updated and adapted to match internal and external requirements. While, the Board of Directors has the overall responsibility to ensure that Alba has implemented necessary procedures for risk management, the oversight of compliance within the established Enterprise Risk Management Framework is delegated to the Board Audit Committee.

Our corporate risk profile provides a consolidated picture of our risk exposure by detailing each risk, risk category and type, as well as level of inherent and residual risks. Our reporting process defines six risk dashboards to include Operational, Financial (Liquidity/Credit/ Covenants), Market/Commodity, Cybersecurity, Compliance, and ESG. The risk descriptions provide details of the event, its status, threshold and an assessment of its likelihood and potential impact. Post discussion with the Executive Management, the Head of Risk consolidates the main risks in a two-dimensional risk ‘heat map’ which is reviewed by the Board Audit Committee on a quarterly basis and if any material updates occur on an ad hoc basis, it is then shared with the Board of Directors.

The following risks must be carefully considered as their occurrence could have a material/ adverse impact on Alba’s business operations, financial condition, and could ultimately result in a decline in the Alba’s share price. Our processes of governance, control and risk management identify and provide responses to key risks through rigorous internal controls. Any failure of these systems could lead to the occurrence, or re-occurrence, of any of the risks described below:

- The cyclical nature of the Company has historically meant that there is significant Aluminium price and demand volatility as well as a relative overproduction/surplus in the industry. The Company has no control over several factors that would affect the price of Aluminium.

- The Company operates in an industry that gives potential rise to health, safety, security and environmental risks: fire, equipment breakdown, attack on the physical or IT infrastructure, civil strike or unrest, or loss of gas, power or other utilities which may result in loss of operational capability or shutdowns for significant periods; hence, resulting in a significant adverse impact on the Company’s operations and financial condition.

- The loss of either of the Company’s three largest customers, or its inability to recover the receivables’ dues from one of them, may have a material adverse effect on its financial condition and prospects.

- The Company relies on third-party suppliers for certain raw materials, and any disruption in its supply chain or failure to renew these contracts at competitive prices may have an adverse impact on the Company’s financial condition, operations, and outlook.

- The Company’s competitive position in the global aluminium industry is dependent on continued access to uninterrupted natural gas supply. Further increase in the price of natural gas, or interruption in its supply, could have a material adverse effect on the Company’s business, financial condition, operations, and outlook.

- The Company’s business may be affected by shortages of skilled employees (including management), labour cost inflation and increased rates of attrition.

- The Company depends on the provision of uninterrupted transportation of raw materials and finished products across significant distances. Interruption of these activities could have a material adverse impact on the Company especially as prices for shipping/transportation services (particularly for sea transport) have increased over more than a year.

- The Company has interest rate hedging contracts in connection to its c.US$766.591 million Syndicated Commercial Loan that is exposed to periodic mark-to-market evaluation

- The Company is exposed to foreign currency fluctuations which may affect its financial condition.

- There is a high level of competition in the GCC aluminium market, and the Company may lose its market share in the GCC as its peers increase their production levels.

- The Company does not insure against certain risks, and some of its insurance coverage may be insufficient to cover actual losses incurred.

- Changes in laws or regulations, or a failure to comply with any laws or regulations, may adversely affect the Company’s business operations.

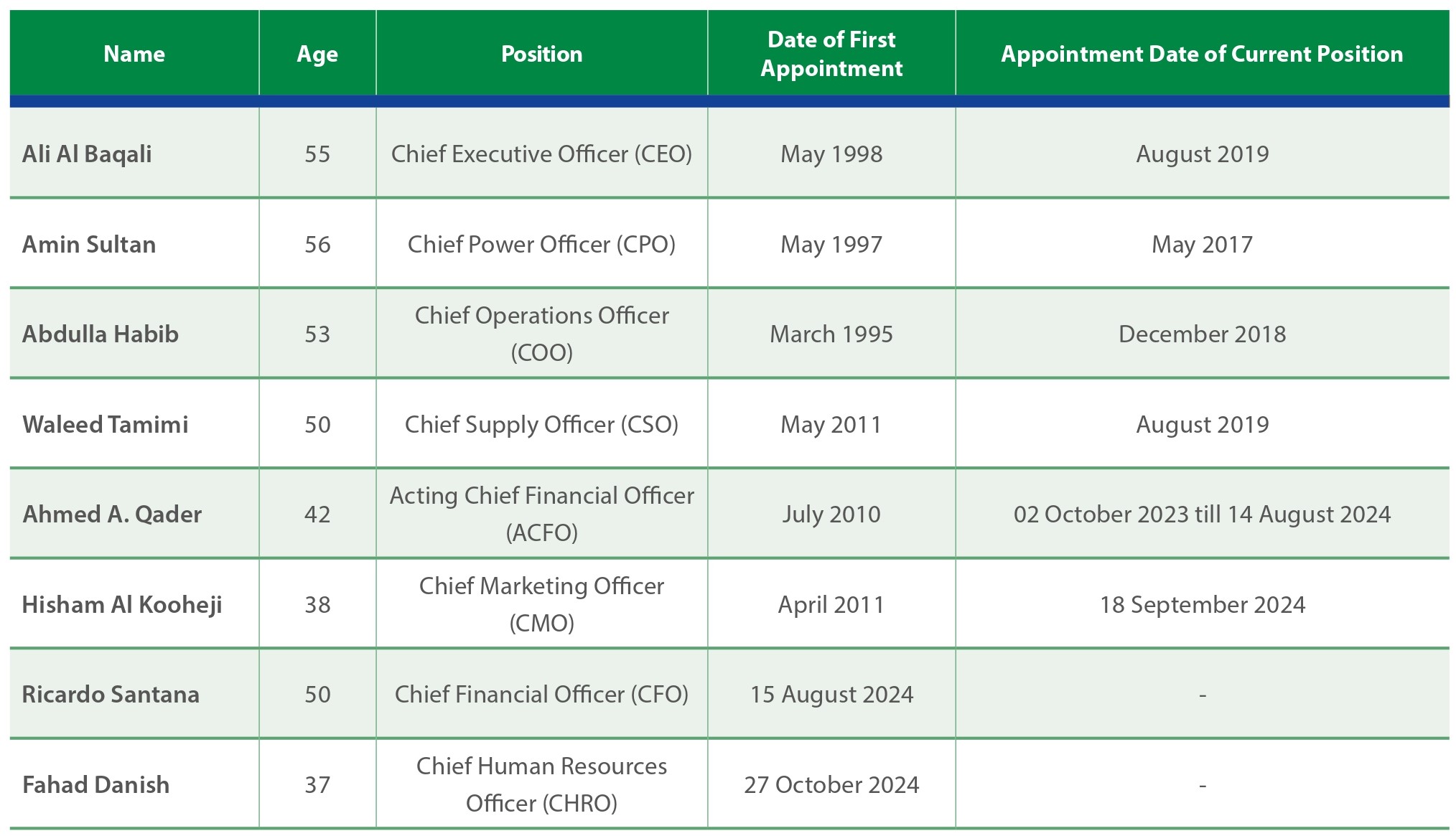

The Company’s Executive Management oversees the day-to-day operations and executes the strategic directives set forth by the Board.

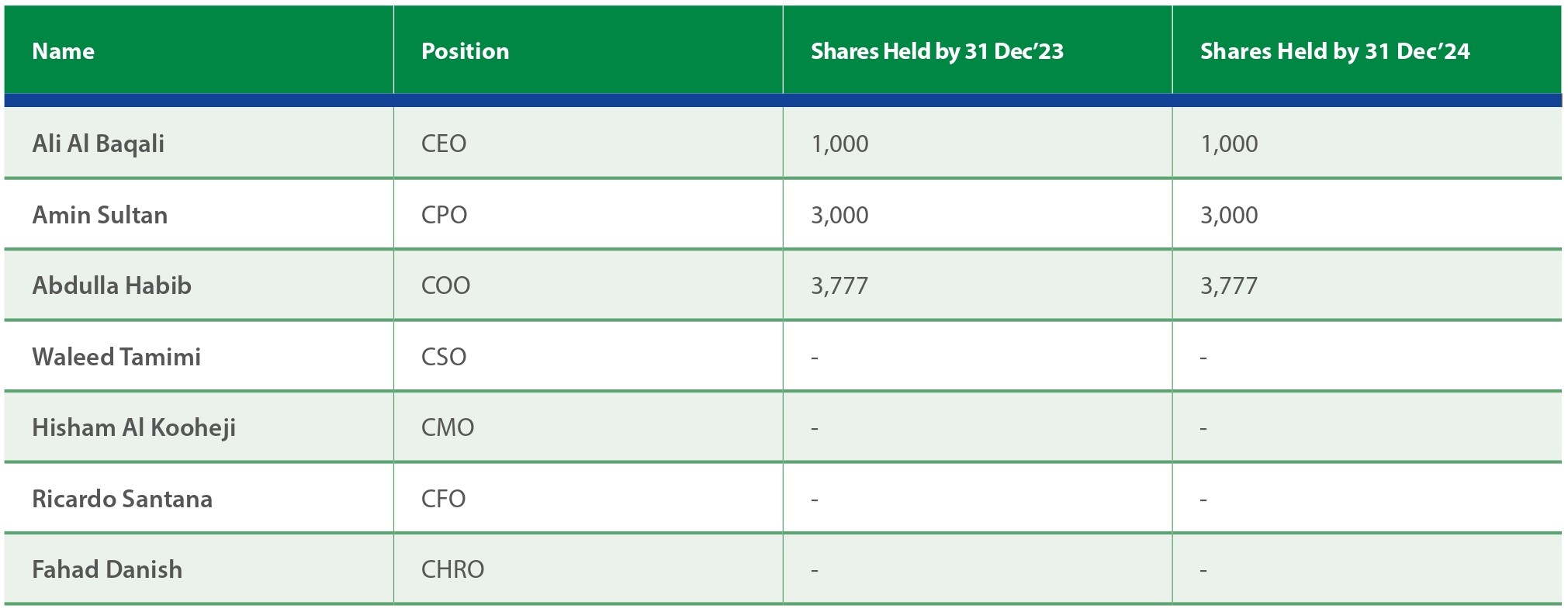

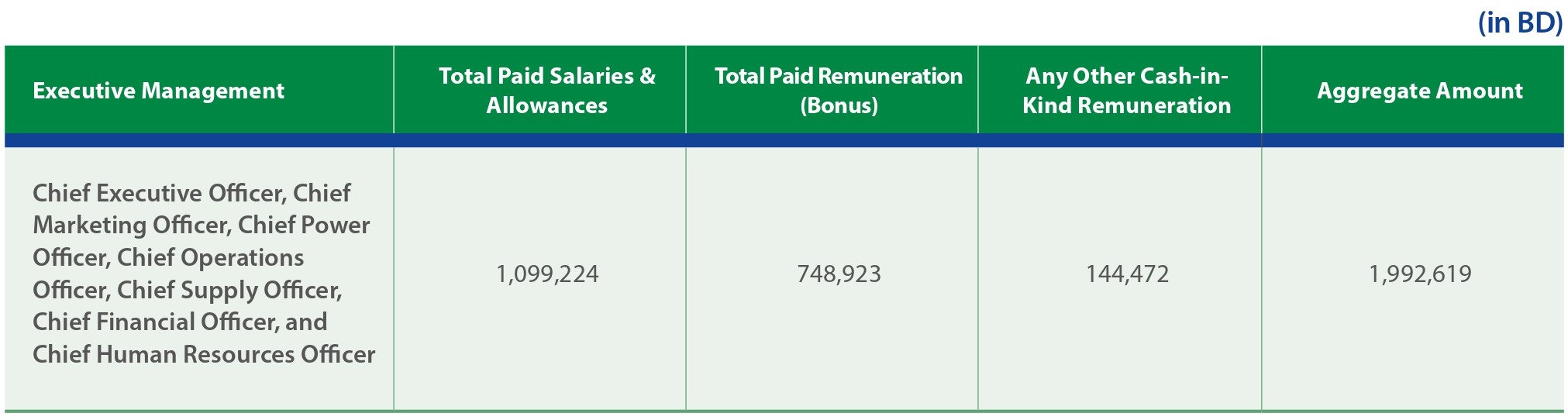

The Company’s well-defined performance system -- guided by the Nomination, Remuneration & Corporate Governance Committee (NRCGC) -- fosters transparency in performance evaluation as well as rewarding employees and key Executives. The top seven key Executives’ compensation -- including salaries, benefits, and allowances -- amounted to BD1,992,619 (full breakdown is tabled below):

The Company recognises that the current composition of the Board, Audit Committee and its Nomination, Remuneration, and Corporate Governance Committee (NRCGC) may not fully comply with the director independence requirements set forth in the Central Bank of Bahrain (CBB) High-Level Controls Module (HC-1.4.5) and the Ministry of Industry and Commerce (MOIC) Corporate Governance Code. The Company has promptly notified its major shareholders of this non-compliance and is actively engaged in discussions with them to seek appropriate remedial measures.

In the interim, the Company has secured a temporary waiver from CBB with respect to the independence requirements. This waiver is subject to ongoing review as the Company undertakes to diligently pursue mitigation strategies including potential Board and NRCGC composition changes to achieve full compliance with CBB regulations and MOIC Code by the new Board term in 2026.

The Board believes the specific circumstances surrounding the Directors’ classification as non-independent do not pose actual conflicts of interest or hinder their ability to exercise independent judgment.

Community-driven impact: the Company spent c.BD2.375 million to touch diverse aspects of local and community life, driving positive change through educational programmes, fostering healthy living through sports, conservation of local heritage, and impactful ESG-led activities in line with the Company’s ESG Roadmap.

-

Guided by the principles of good corporate

governance, Alba Board of Directors reviewed on 13

February the Company’s House of Strategy with key

focus areas on growth initiatives, energy

transition, financial sustainability, risk

management, and ESG. In addition, the Board of

Directors approved the following new Vision,

Mission and Values for Alba

- Vision: To drive the aluminium industry forward through human talent and innovation from Bahrain to the world.

- Mission: Drive long-term sustainable value for all stakeholders by capitalising on the strength of our product portfolio, anchored in our enduring dedication to safety and efficiency

- Values: Safe & Green, Team, Ethics, Excellence and Resilience.

- To ensure effective oversight of the contemplated combination of Alba with segments of Maaden’s Aluminium Strategic Business Unit, Alba Board of Directors established a dedicated Steering Committee on 14 May. The Steering Committee is tasked with guiding the project’s execution, overseeing due diligence activities and ensuring alignment with the Company’s strategic objectives

- Alba announced on 16 September a Non-Binding Agreement to Explore Potential Business Combination with Segments of Maaden’s Aluminium Strategic Business Unit.

- Alba was notified on 17 September by its shareholder, SABIC Industrial Investment Company (SIIC) (a wholly owned subsidiary of SABIC) of an agreement for the sale of its 20.62% shareholding in Aluminium Bahrain B.S.C. to Saudi Arabian Mining Company (Ma’aden). [SABIC Industrial Investment Company (SIIC) has a substantial shareholding of more than 10% in Alba’s issued and paid-up capital and as such, this transaction is subject to CBB’s approvals]

- Succession planning is a critical component of the Board’s strategic oversight. A dedicated workshop was held on 18 September to review and refine the Company’s succession planning process as well as ensure its long-term sustainability.

Alba engages with its shareholders and investors on a regular basis and as required as follows:

- Alba was converted into a Bahrain Public Joint Stock Company on 23 November 2010.

- Alba shares are listed on two exchanges: Ordinary Shares on Bahrain Bourse and Global Depository Receipts (GDRs) on the London Stock Exchange – Alternative Investment Market.

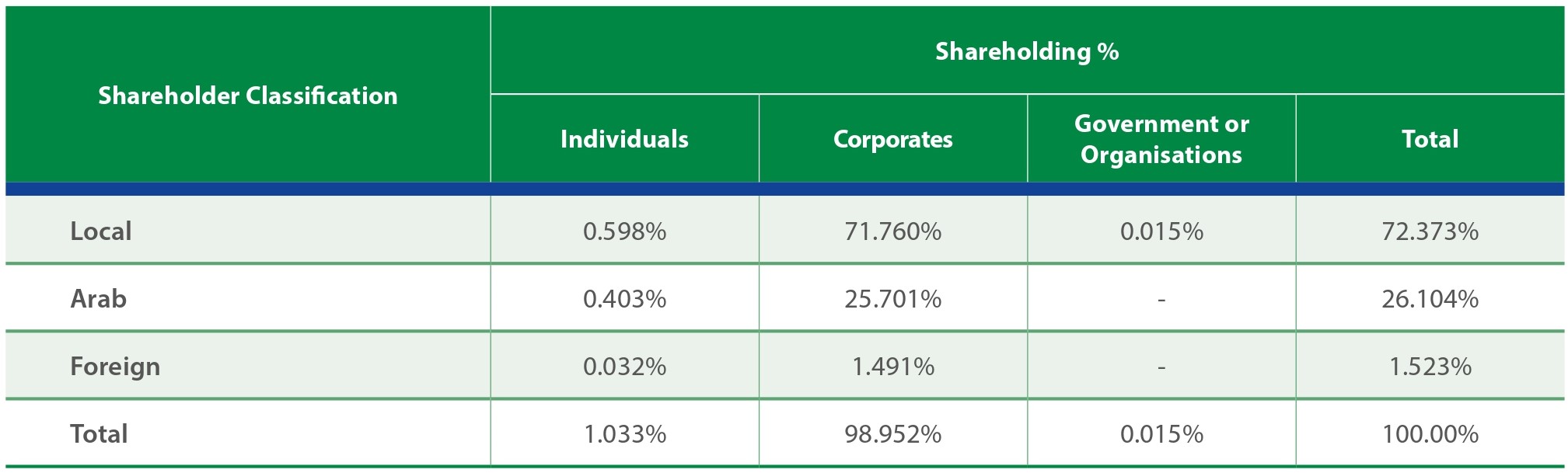

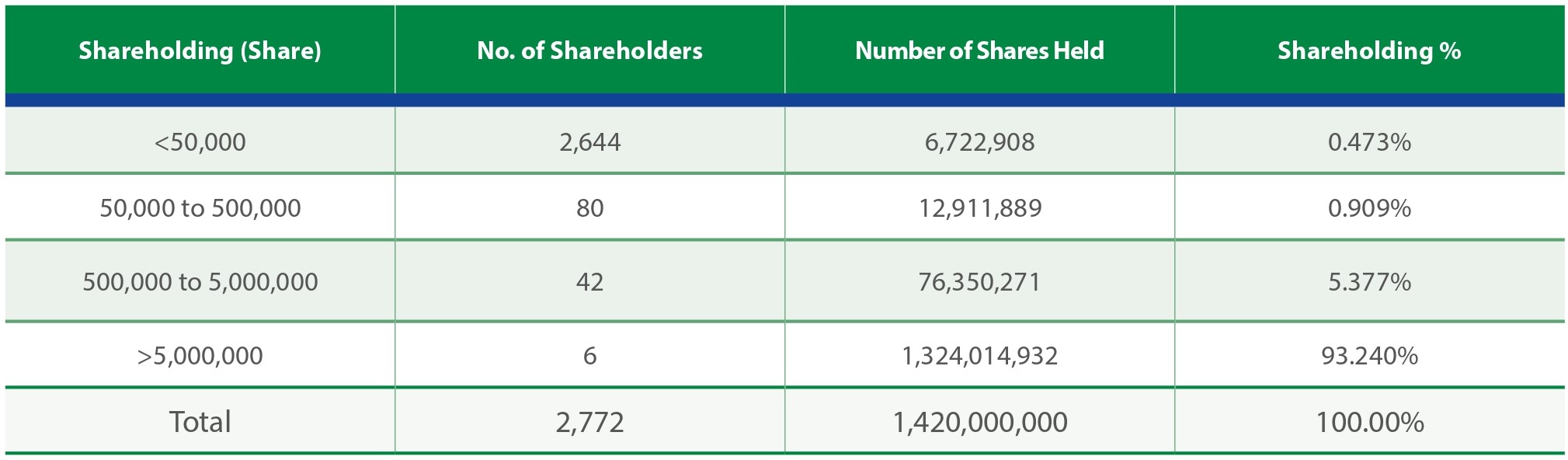

- Alba Ticker [Bahrain Bourse: ALBH, BD1.300 on 31 December 2024].The below detailed tables outlines shareholders’ equity and distribution, offering insights in the Company’s ownership in terms of local, Arab and Foreign, in addition, to distribution by size of ownership: