2023: Global Market in Focus (Demand & Supply)

Rolling Ingots

T-Ingots

Mixed Macroeconomic Outlook in 2024: Supply Constraints & Demand Upturn

• Global demand is expected to see a gradual rebound in the latter half of 2024 fueled by anticipated Chinese stimulus measures into their economy, prospects of interest rate cuts in the US boosting consumer spending and gradual recovery in Europe as consumption picks up after a sluggish start.

• Russian aluminium exports to EU are likely to decline due to expected trade sanctions against Russia diverting exports to Asia particularly China.

• US aluminium offtake is projected to grow in 2024 despite anticipated GDP slowdown, mainly driven by investments and expansions in casting, extrusions, and rolling sectors.

• European demand is likely to remain passive in H1 2024 due to stagnant construction activity & high interest rates dampening business and consumer confidence.

• Demand in China is expected to expand, despite a weak construction sector, thanks to growth in auto and renewable energy sectors.

• Global supply chain challenges have improved, but some risks remain on routes like Panama and Suez Canals.

• Bearish market sentiment is likely to persist with LME prices ranging between US$2,000 /t – US$2,200/t.

Properzi Ingots

Sales by Geographic Footprint

AMERICAS

EUROPE

BAHRAIN

MENA

ASIA

of Alba products are exported worldwide through its Sales offices in Zurich & Singapore as well as a Subsidiary in Atlanta - US

For more details regarding Alba’s Aluminium

Products please scan the QR Code

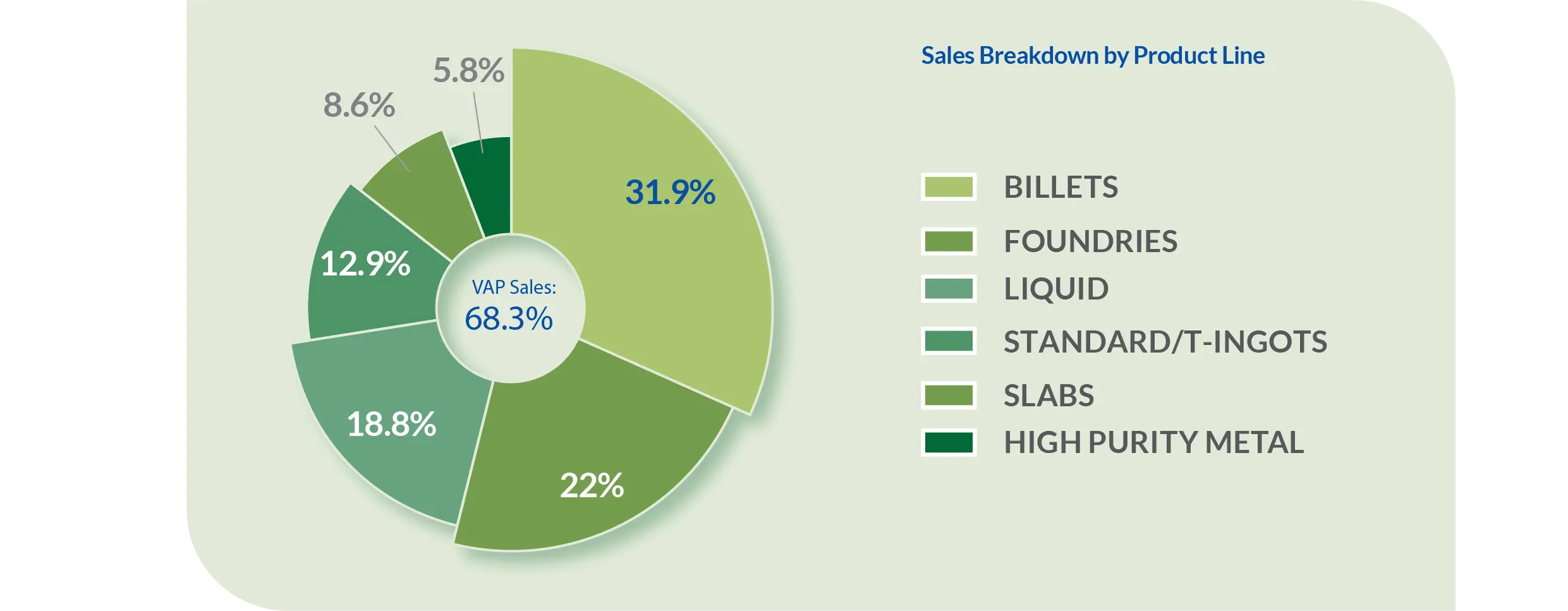

2023 Metal Sales

billion

Metal Sales Volume

metric tonnes (mt)

Value-Added

Product (VAP) Sales

metric tonnes (mt)