Chairman of the Board of Directors of Aluminium Bahrain B.S.C. (Alba)

Chairman of the Board Executive & Environment Social and Governance Committee

Chairman of the Nomination, Remuneration and Corporate Governance Committee

Non-Executive / Independent Member since 2014

B.S.B.A. International Business at The American University Washington D.C., U.S.A. (1991)

Leadership Management Program (Gulf Executive Program) from the University of Virginia, Darden School, U.S.A. (1999)

Member of the Board of Directors of Aluminium Bahrain B.S.C.(Alba)

Chairman of the Board Audit Committee

Non-Executive / Independent Member since 2008

Certified Public Accountant

Bachelor of Accounting from Husson College, USA

Member of the Board of Directors of Aluminium Bahrain B.S.C.(Alba)

Member of the Board Audit Committee

Non-executive/ Non-Independent Member since 2014

Certified Public Accountant

Bachelor of Science in Accounting from the University of Bahrain

Member of the Board of Directors of Aluminium Bahrain B.S.C.(Alba)

Member of the Board Executive & Environment Social and Governance Committee

Non-executive/ Non-Independent Member since 2015

MBA degree from Stanford University

Master of Science in Nuclear Engineering from Princeton University

Bachelor of Science in Nuclear Physics & Mathematics from the University of Denver

Member of the Board of Directors of Aluminium Bahrain B.S.C. (Alba)

Member of the Board Audit Committee

Non-Executive / Independent Member since 2020

Master of Science in Global Financial Analysis from Bentley University, Waltham, MA

Member of the Board of Directors of Aluminium Bahrain B.S.C.(Alba)

Member of the Board Executive & Environment Social and Governance Committee

Non-executive/ Non-Independent Member since 2019

Bachelor of Science in Chemical Engineering from the King Fahd University of Petroleum and Minerals (KFUPM)

MS in Chemical Engineering from Drexel University, USA

Member of the Board of Directors of Aluminium Bahrain B.S.C.(Alba)

Member of the Board Executive & Environment Social and Governance

Non-executive/ Non-Independent Member since 2022

MBA from Vanderbilt University

Degree in Accounting from Susquehanna University

A member of the American Institute of CPAs

Member of the Board of Directors of Aluminium Bahrain B.S.C.(Alba)

Member of the Nomination, Remuneration and Corporate Governance Committee

Non-executive/ Non-Independent Member since 2020

Graduate of the University of Pennsylvania Law School

A member of the New York Bar & qualified to practice law in Bahrain

Member of the Board of Directors of Aluminium Bahrain B.S.C. (Alba)

Member of the Nomination, Remuneration and Corporate Governance Committee

Non-Executive / Non-Independent Member since 2020

Bachelor’s in Mining Engineering

Member of the Board of Directors of Aluminium Bahrain B.S.C.(Alba)

Member of the Board Audit Committee

Non-executive/ Non-Independent Member since 2020

Mechanical Engineering from University of Missouri at Columbia, USA Master’s in Industrial Management from University of Sheffield, UK

Been in various training programs in technical/business/ financial/leadership fields; one of the latest is Strategic Financial Analysis at Harvard Business School

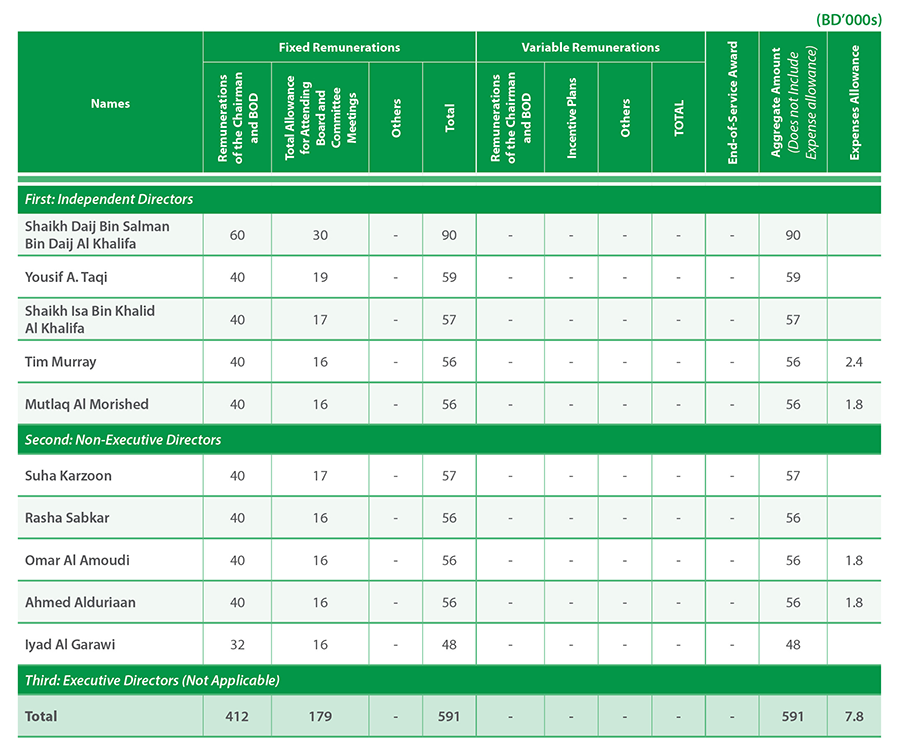

Alba’s Board of Directors are renumerated fairly and responsibly for fulfilling the duties of the Board and its Committees.

For 2021, Remuneration Fees were BD420,000 [BD60,000 for the Chairman and BD40,000 per Director] excluding Sitting Fees (BD72,000) and Attendance Fees (BD1,000 per Director per meeting) of BD103,000. In total, the aggregate amount for 2021 was BD595,000 in addition to Expense Allowances of BD14,100 [refer to Note 27 in Alba’s Consolidated Financial Statements of 2022].

For 2022, Attendance Fees (BD1,000 per Director per meeting) and Allowance Fees* were paid to the Directors for attending the Board and Committees during 2022. Sitting fees of BD72,000 for 2022 (part of Total Allowance for Attending Board and Committee Meetings) were paid after the Board’s meeting on 02 February 2023 (to refer to the below table for the full breakdown of 2022 Remunerations).

The proposed Remuneration Fees for 2022 will be paid post the AGM which is scheduled to be held on 26 February 2023 and subject to the shareholders’ approvals.

* as per Policy for the Board Directors and Board Committee Members' remuneration Fees, Attendence Fees and Per Diem Allowance)

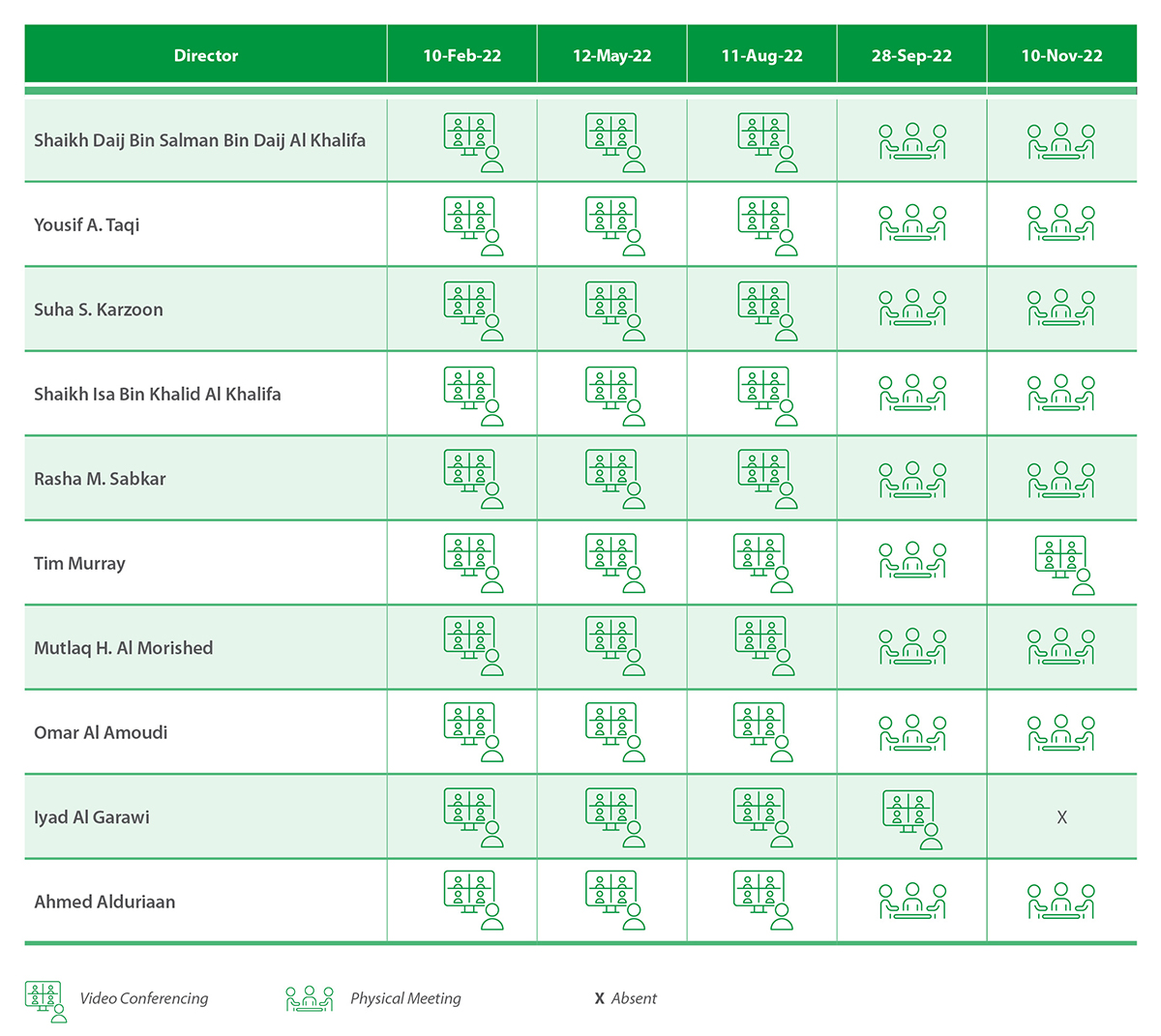

Meetings of the Company’s Board of Directors are held at least quarterly or more frequently as deemed necessary. There were 5 Board Meetings in 2022 which were held on 10 February, 12 May, 11 August, 28 September, and 10 November. Board meetings in Q1 and Q2 of 2022 (2 meetings) were held virtually via Microsoft Teams while meetings in Q3 and Q4 of 2022 (3 meetings) were held via Microsoft Teams and in-person.

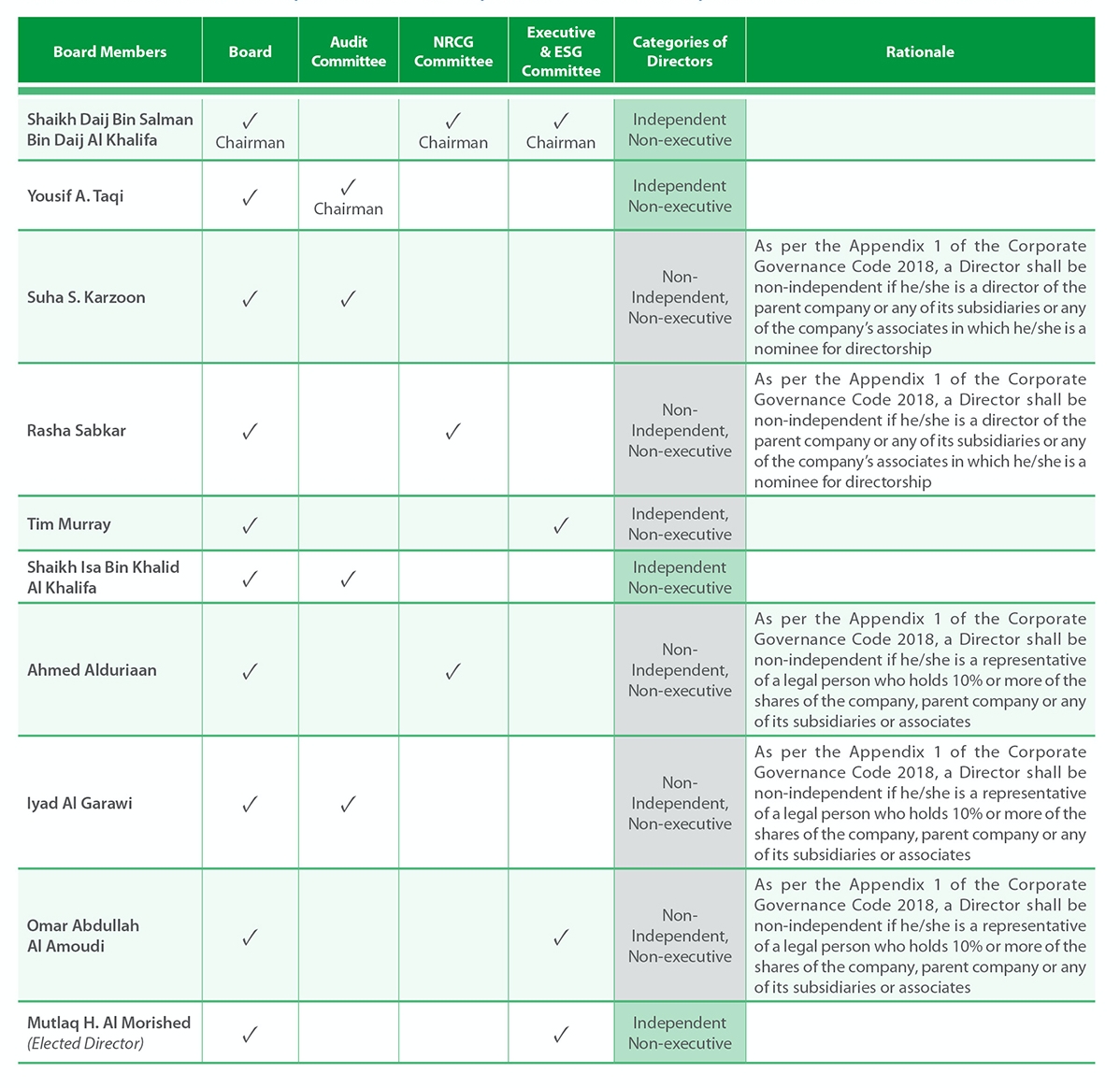

Pursuant to Chapter 2 -- Corporate Governance Principles, Section One, Principle 1: the Company Shall be Headed by an Effective, Qualified and Expert Board -- in the Corporate Governance Code 2018, the Chairman of the Board responsibilities include but not limited to:

Pursuant to Chapter 2 -- Corporate Governance Principles, Section One, Principle 1: the Company Shall be Headed by an Effective, Qualified and Expert Board -- in the Corporate Governance Code 2018 and in addition to Alba’s Memorandum and Articles of Association of the Company (the “Articles”), the Board’s duties include but not limited to:

The Levels of Authority (LOA) summarises areas relating to strategies, long-term commitments, and policies where approval of the Board is necessary. These include:

Alba undertakes transactions with related parties as part of its ordinary course of business. As per the definitions by the International Accounting Standards (IAS) 14, the Company qualifies as a government related entity. The Company purchases gas and receive services from various government and semi-government organizations and companies in the Kingdom of Bahrain. Other than the purchase of natural gas, other conducted transactions for the normal course of business are not considered to be individually significant in terms of size. Related party transactions of material nature are discussed by the Board and are as follows:

In addition, around 50% of the land housing Alba’s various facilities is licensed or leased to the Company by the Government of Bahrain or entities like BAPCO, which are wholly owned and controlled by it. Further information can be found in Note 27 – Transactions with Related Parties in Alba’s Consolidated Financial Statements of 2022.

One Board Director holds Alba ordinary shares; there has not been any change in his shareholding status: Mutlaq H. Al Morished’s Shareholding as at:

Three Directors (Shaikh Isa bin Khalid Al Khalifa, Ahmed AlDuriaan and Iyad Al Garawi), who have been appointed in March 2020, visited Alba Campus on 30 November 2021 as part of their induction to get an up-close and personal tour around different areas of the smelter, including Calciner and Marine, Reduction Lines 5 & 6, Casthouse 4, Power Station 3 as well as HRH Princess Sabeeka Oasis.

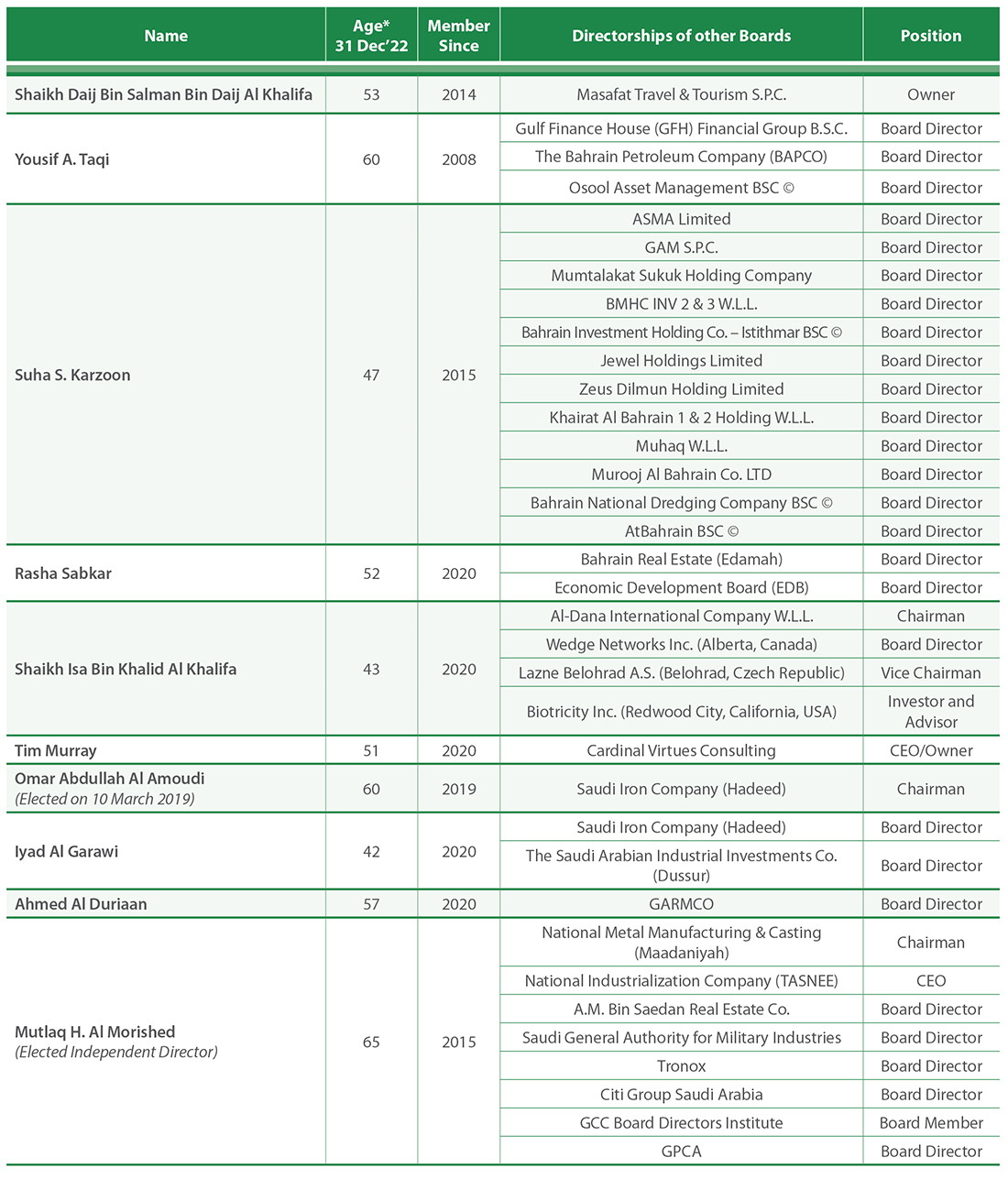

The Company shall be administered by a Board of Directors consisting of 10 (ten) Directors to be appointed and/ or elected in accordance with the provisions of the Articles of Association and Article 175 of the Commercial Companies’ Law of the Kingdom of Bahrain (the “Law”). As per Article 24.5 of Alba’s Articles of Association, the members of the Board of Directors shall be elected for 3-year renewable term.

The recent term begun on 08 March 2020 and the new term will be effective after the AGM (26 February 2023).

The membership of the Directors concludes upon the expiry of the term upon which the Director will be subject to reelection. The termination of directorship can also take effect if any Director is in breach of the conditions set out in Article 27 of the Alba’s Articles of Association.

In line with Chapter Two: Section One: Principle Eight of the Code, the Board and its Committees conduct an annual performance assessment (including individual evaluation) to determine whether the Board, its Committees and its Directors are capable of providing high level of judgement. For the year-ended 2022, all Directors have completed the Board and Committees’ questionnaires.